(Bloomberg) -- The European Union dodged an imminent trade war with the US this week, but markets and a growing chorus of critics have dispelled early hopes that the deal will bring a sense of stability back to transatlantic relations.

Most Read from Bloomberg

-

Budapest’s Most Historic Site Gets a Controversial Rebuild

-

San Francisco in Talks With Vanderbilt for Downtown Campus

-

Can This Bridge Ease the Troubled US-Canadian Relationship?

-

Trump Administration Sues NYC Over Sanctuary City Policy

The euro fell to a five-week low of $1.1527 on Tuesday, having fallen about 1.8% since the trade deal was announced. That’s after the common currency had surged to a near three-year high last week on the prospect of an agreement with the US.

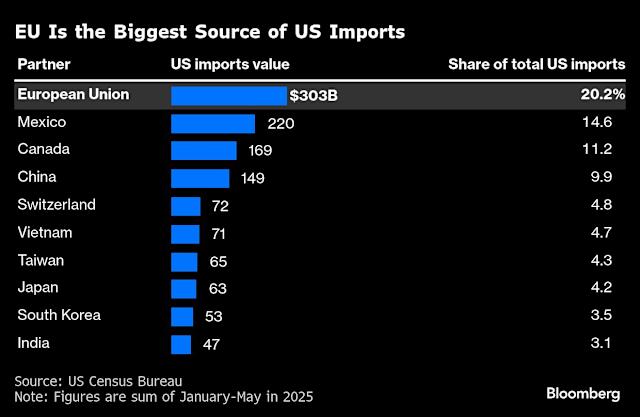

The EU over the weekend agreed to accept a 15% tariff on most of its exports, while the bloc’s average tariff rate on American goods should drop below 1% once the deal goes into effect. Brussels also said it would purchase $750 billion in American energy products and invest $600 billion more in the US.

“The free trade principles that have underpinned transatlantic prosperity since the end of World War II are being systematically dismantled,” Karin Karlsbro, a Swedish member of the European Parliament’s trade committee, said in a statement. “The risk of European economic and political marginalization grows with each concession made.”

German Chancellor Friedrich Merz, who initially cheered the deal as having “succeeded” in avoiding a trade conflict and enabling the EU to safeguard its interests, seemed to sour on the accord.

“The German economy will suffer significant damage from these tariffs,” he told reporters Monday. “I’m pretty sure this won’t be limited to Germany and Europe. We’ll also see the consequences of this trade policy in America.”

French Prime Minister Francois Bayrou was also critical, saying on social media: “It’s a dark day when an alliance of free peoples, united to affirm their values and defend their interests, opts for submission.”

The EU and US will seek to clinch a non-legally binding joint statement by Aug. 1 that will expand on some of the elements negotiated over the weekend, according to a senior EU official. Once the statement is finalized, the US will begin lowering its tariffs on specific sectors, in particular for cars and car parts, which currently face a 27.5% levy.

The two sides will then start work on a legally binding text, said the official, who spoke on the condition of anonymity. The content and legal form of this document aren’t clear, but it would require the support of at least a qualified majority of EU countries and possibly the European Parliament.

Story ContinuesThe EU official said that reaching a consensus on the legal text could take a long time; many trade accords require years of negotiations. The EU won’t start implementing the terms it agreed to — such as lowering tariffs on US products — until after this legal text is approved, according to the official.

“The agreement removes some tail downside risks but is short on details, which will need to be thrashed out over the coming weeks, risking new volatility,” Oliver Rakau — chief Germany economist at Oxford Economics — said in a note. “Uncertainty is likely to remain elevated.”

European Commission President Ursula von der Leyen said that the US agreed to bilaterally lower tariffs to zero on certain strategic products, including aircraft and component parts, certain generics, semiconductor equipment and some agricultural products.

One potential sticking point in negotiations will be EU metal exports, which currently have a 50% tariff rate. The EU is pushing for a quota on metals that would lower the levies on a certain volume of goods, while anything above that would pay the 50% rate, according to the EU official.

“Uncertainty remains regarding all the details concerning the European steel industry,” said Axel Eggert, director-general of the European Steel Association.

EU ambassadors will meet on Tuesday to discuss the trade situation.

Discussions are ongoing on whether some goods, such as wine and spirits, would be exempt from the 15% tariff rate, the EU official said.

Another possible issue is the EU’s promise to purchase $750 billion of American energy imports over three years, an integral part to securing the deal. Yet it’s hard to see how the EU attains such ambitious flows over such a short time frame.

Total energy imports from the US accounted for less than $80 billion last year, far short of the promise made by von der Leyen to Trump. Total US energy exports were just over $330 billion in 2024.

The EU’s pledge to invest an additional $600 billion in the US is just as problematic. The investment is just an aggregate of pledges by companies and not a binding target as the European Commission can’t commit to such goal, said the EU official.

The uncertainty from the trade war has weighed on EU economic forecasts, with the commission in May cutting its GDP growth expectations for the year to 1.1%. It projected a 1.5% rate in November.

Despite the critics, the commission, which handles trade matters for the EU, insists this was the only course of action.

“This is clearly the best deal we could get under very difficult circumstances,” Maros Sefcovic, the EU’s trade chief, told reporters on Monday.

--With assistance from Michal Kubala, Arne Delfs, John Ainger, David Goodman and Julien Ponthus.

(Updates with currency move in the second paragraph.)

Most Read from Bloomberg Businessweek

-

Burning Man Is Burning Through Cash

-

It’s Not Just Tokyo and Kyoto: Tourists Descend on Rural Japan

-

Cage-Free Eggs Are Booming in the US, Despite Cost and Trump’s Efforts

-

Everyone Loves to Hate Wind Power. Scotland Found a Way to Make It Pay Off

-

Elon Musk’s Empire Is Creaking Under the Strain of Elon Musk

©2025 Bloomberg L.P.