GlobalData surveying has found that industry insiders view embedded insurance as the fastest-growing distribution channel in personal lines insurance over the next five years. Meanwhile, the British insurtech company Wrisk announced the successful closing of its Series B funding round, securing £12m ($16.1m) to advance its strategic vision and fuel growth for embedded insurance.

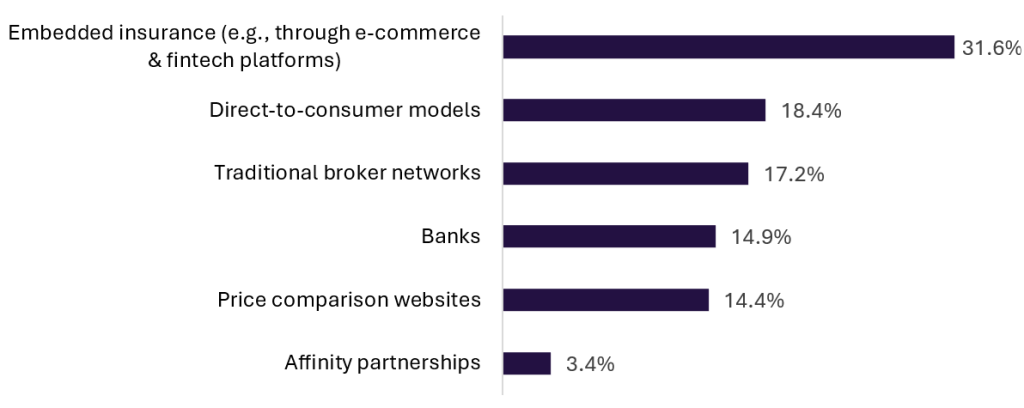

According to a poll conducted by GlobalData on Verdict Media sites in Q1 2025, which surveyed industry insiders, 31.6% of respondents believe that embedded insurance will experience the most significant growth within personal lines insurance over the next five years. Embedded insurance outpaced direct-to-consumer models (18.4%) and traditional broker networks (17.2%).

Which distribution channel will see the most growth in personal lines insurance over the next five years? 2025

Industry insiders see embedded insurance as the channel with the most potential for growth because they place the cover exactly where and when consumers make purchasing decisions, removing extra steps and thus improving conversion rates. In addition, by partnering with non-insurance ecosystems such as ecommerce, insurers can tap into previously underserved segments with low distribution costs.

Wrisk is a London-based leading embedded insurance provider in the automotive sector, providing a digital platform that allows automotive brands to integrate tailored motor insurance solutions directly into their sales and service platforms. The insurance solution is embedded beyond the purchase stage, accompanying customers throughout their ownership journey. Wrisk has secured collaboration with major players in insurance and the automotive industry, including Allianz and BMW. Its technology enables it to utilise real-time data and telematics to personalise insurance offerings, improving the customer experience.

With the £12m injection, Wrisk will be able to accelerate the development of its API-first platform and expand its footprint in the European market. Its successful funding round reflects the market’s confidence in embedded insurance as a way to drive digital transformation and ensure significant growth.

Given the potential of the embedded insurance market, traditional insurance providers would benefit from seeking partnerships with insurtech companies to leverage the advantages of embedded insurance. Such partnerships would enable the seamless integration of insurance products into the customer journey and expand distribution channels.

"Embedded insurtech provider Wrisk raised £12m in Series B closing" was originally created and published by Life Insurance International, a GlobalData owned brand.

Story Continues

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.