Regency Centers Corp. REG seems well-poised to gain from its strategically located premium portfolio of grocery-anchored shopping centers. Strategic buyouts and an encouraging development pipeline bode well for long-term growth. A healthy balance sheet provides financial flexibility for portfolio expansion.

Analysts seem positive about this Zacks Rank #2 (Buy) company. The Zacks Consensus Estimate for REG’s 2025 funds from operations (FFO) per share has moved marginally northward over the past three months to $4.54.

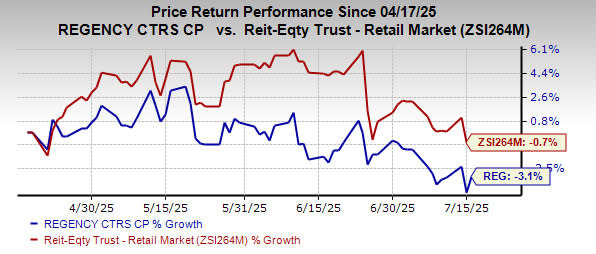

Over the past three months, shares of this retail real estate investment trust (REIT) company have lost 3.1% compared with the industry's fall of 0.7%. Given its solid fundamentals and positive estimate revisions, the stock is likely to keep performing well in the quarters ahead.

Image Source: Zacks Investment Research

Factors That Make Regency Centers a Solid Pick

Healthy Operating Fundamentals & Rent Growth: Regency’s premium shopping centers are situated in affluent suburban areas and near the urban trade areas where consumers have high spending power, enabling the company to attract top grocers and retailers.

Regency’s embedded rent escalators have also been a key driving factor behind its rent growth. In the first quarter of 2025, same-property base rents contributed 4% to same-property net operating income growth.

Grocery Anchored Tenant Base: In uncertain times, the grocery component has benefited retail REITs, and Regency Centers has numerous industry-leading grocers such as Publix, Kroger, Albertsons Companies ACI, TJX Companies, Inc. TJX and Amazon/Whole Foods as tenants. It has a high-quality open-air shopping center portfolio, with more than 80% grocery-anchored neighborhood and community centers. Six of its top 10 tenants are high-performing grocers.

Strategic Expansion Efforts: To enhance its portfolio, REG has been undertaking acquisitions and developmental activities. Given its prudent financial management, it is well-poised to capitalize on growth opportunities.

In the first quarter of 2025, Regency acquired Brentwood Place Shopping Center, a premier retail destination in Brentwood, TN, for around $119 million at its share. During the same period, the company also purchased an outparcel adjacent to its Orange Meadows shopping center in Orange, CT, for around $4 million at its share and its partner's interest in Putnam Plaza in Carmel, NY, for around $10 million.

As of March 31, 2025, Regency’s in-process development and redevelopment projects have estimated net project costs of around $499 million at the company’s share. Following its impressive execution in 2024, with more than $250 million of development and redevelopment starts, management expects to drive a similar level of success in 2025.

Story ContinuesBalance Sheet Strength: Regency maintains a healthy balance sheet position. As of March 31, 2024, this retail REIT had nearly $1.2 billion of capacity under its revolving credit facility and approximately $78.5 million of cash and equivalents. The company has a well-laddered debt maturity schedule and aims to have nearly 15% of total debt maturing in any given year.

In February 2025, S&P Global Ratings raised its credit ratings to ‘A-’ with a stable outlook for the company, boosting lenders’ confidence. Moreover, the investment-grade credit ratings of ‘A3’ from Moody’s render it access to the debt market at favorable costs.

Solid Dividend Payment: Solid dividend payouts are the biggest attraction for REIT investors, and Regency is committed to boosting shareholder wealth. In November 2024, the company declared a quarterly cash dividend payment on its common stock of 70.5 cents, an increase of 5.2% from the prior quarter's dividend. From 2014 to the fourth quarter of 2024, REG’s dividend witnessed a CAGR of 3.7%. In the last five years, the company has increased its dividend three times. Check Regency Centers’ dividend history here.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Albertsons Companies, Inc. (ACI) : Free Stock Analysis Report

Regency Centers Corporation (REG) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research