For new and old investors, taking full advantage of the stock market and investing with confidence are common goals.

Achieving those goals is made easier with the Zacks Style Scores, a unique set of guidelines that rates stocks based on popular investing methodologies, namely value, growth, and momentum. The Style Scores can help you narrow down which stocks are better for your portfolio and which ones can beat the market over the long-term.

Why Investors Should Pay Attention to This Value Stock

Value investors love finding good stocks at good prices, especially before the broader market catches on to a stock's true value. Utilizing ratios like P/E, PEG, Price/Sales, and Price/Cash Flow, the Value Style Score identifies the most attractive and most discounted stocks.

Array Technologies, Inc. (ARRY)

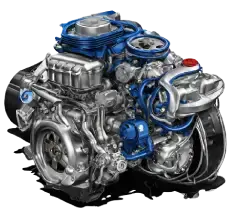

Boulder, CO-based Array BioPharma is a biopharmaceutical company focused on the discovery, development and commercialization of targeted small molecule drugs for treating cancer and other high-burden diseases. The company has one marketed combination therapy in its portfolio – Braftovi (encorafenib) plus Mektovi (binimetinib). The therapy is approved for treating unresectable or metastatic melanoma with a BRAF V600E or V600K mutation. The company is also conducting label expansion studies for the combination therapy.

Invest in Gold

American Hartford Gold: #1 Precious Metals Dealer in the Nation

Learn More

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

Thor Metals Group: Best Overall Gold IRA

Learn More Powered by Money.com - Yahoo may earn commission from the links above.ARRY is a Zacks Rank #3 (Hold) stock, with a Value Style Score of A and VGM Score of A. Shares are currently trading at a forward P/E of 10.6X for the current fiscal year compared to the Solar industry's P/E 15.8X. Additionally, ARRY has a PEG Ratio of 0.5 and a Price/Cash Flow ratio of 2.5X. Value investors should also note ARRY's Price/Sales ratio of 1X.

Many value investors pay close attention to a company's earnings as well. For ARRY, six analysts revised their earnings estimate upwards in the last 60 days, and the Zacks Consensus Estimate has increased $0.05 to $0.66 per share for 2025. ARRY boasts an average earnings surprise of 40%.

With strong valuation and earnings metrics, a good Zacks Rank, and top-tier Value and VGM Style Scores, investors should strongly think about adding ARRY to their portfolios.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Array Technologies, Inc. (ARRY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

![Lobster Market Growth: Key Factors Driving Expansion to USD [9.6 Billion] by {2029}](https://noticiasdecostarica.com/zb_users/upload/2025/07/20250714121902175246674235065.png)