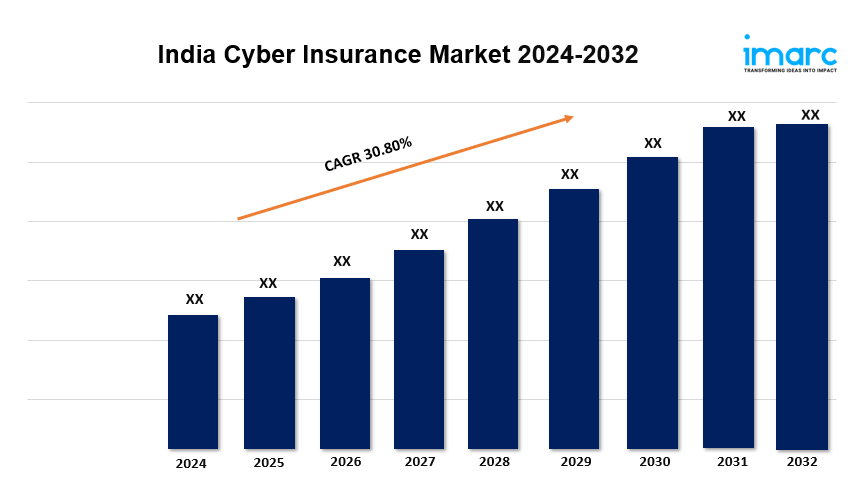

India Cyber Insurance Market Size, Industry Trends, Share, Growth and Report 2024-2032

Cyber Insurance Market- India

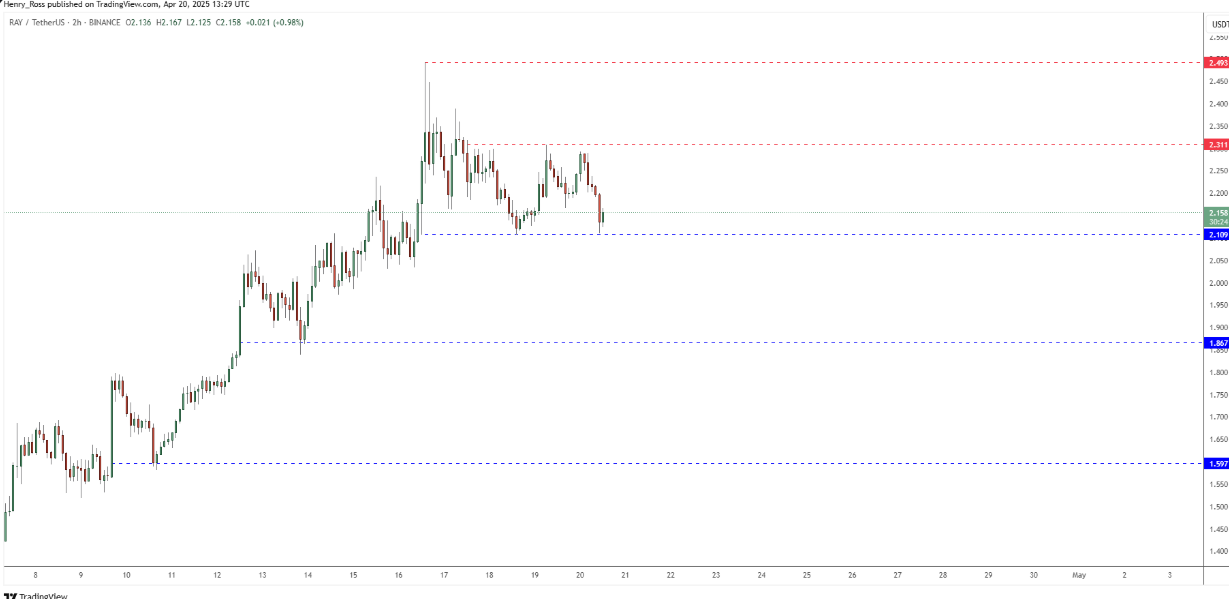

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 30.80% (2024-2032)

The India cyber insurance market is rapidly growing, driven by increasing cyber threats, regulatory requirements, and rising awareness among businesses. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 30.80% from 2024 to 2032.

India Cyber Insurance Market Trends and Drivers:

Rapid Expansion: The market is growing swiftly due to rising cybersecurity awareness among individuals and organizations.Increased Vulnerability: Businesses face higher risks from ransomware, data breaches, and cyberattacks due to digitization of operations.Regulatory Pressure: Stringent regulations, like the Personal Data Protection Bill, encourage companies to adopt cyber insurance to mitigate financial losses.Investment Growth: The surge in investments in cloud services, digital payments, and e-commerce is driving demand for cyber risk management.Impact of COVID-19: The shift to remote work has exposed new vulnerabilities, making cyber insurance crucial for protecting sensitive data and IT systems.Comprehensive Policies: Insurers are focusing on comprehensive policies that not only cover financial losses but also offer support services like legal assistance and crisis management.Evolving Threats: As cyberattacks become more sophisticated, insurance providers are enhancing their offerings to address these challenges.SME Awareness: Small and medium enterprises (SMEs) are increasingly recognizing the importance of cyber insurance in their risk management strategies.Collaborative Efforts: Rising collaborations between insurers and cybersecurity firms are leading to tailored insurance products for specific industries.Digital Transformation: Ongoing digital transformation in finance, healthcare, and retail sectors is expected to drive market growth.Future Outlook: The convergence of these factors is anticipated to propel the expansion of the India cyber insurance market in the coming years.India Cyber Insurance Market Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest cyber insurance market size in India. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Breakup by Component:

SolutionServicesBreakup by Insurance Type:

PackagedStand-aloneBreakup by Organization Size:

Small and Medium EnterprisesLarge EnterprisesBreakup by End Use Industry:

BFSIHealthcareIT and TelecomRetailOthersBreakup by Region:

North IndiaWest and Central IndiaSouth IndiaEast and Northeast IndiaCompetitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email'protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145