Jefferies maintains Buy on Alibaba shares, cites strong AI-driven cloud growth

Investing.com -- Jefferies reiterated its Buy rating on Alibaba (NYSE:BABA) shares on Wednesday, highlighting accelerating cloud revenue growth and record momentum in instant commerce operations as key catalysts.

Looking ahead to Alibaba’s June-quarter results, Jefferies wrote: “Accelerating Cloud revenue growth is expected due to solid AI demand,” estimating Cloud Intelligent Group revenue growth of 23% year over year, ahead of both its prior 20% forecast and market consensus.

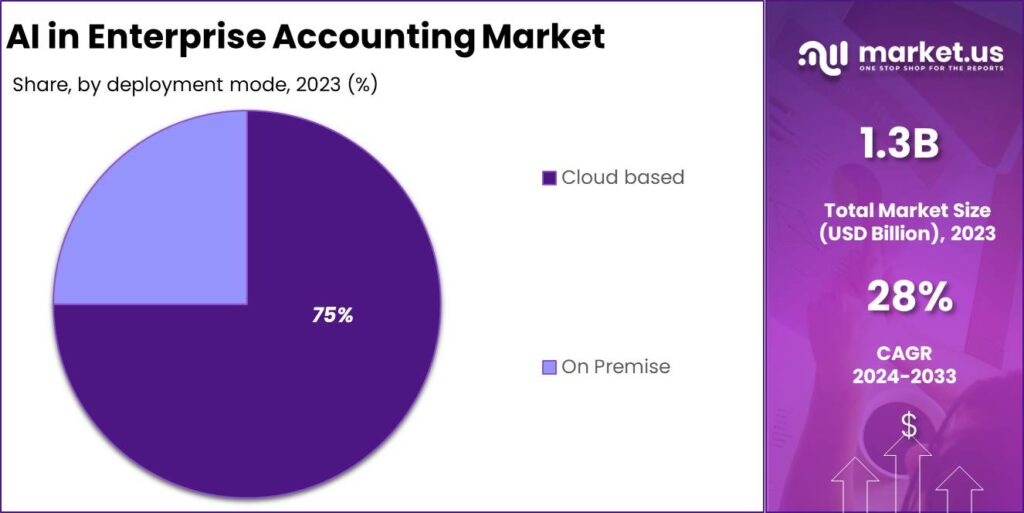

The firm noted this momentum is being driven by rising enterprise demand for artificial intelligence applications.

Jefferies also pointed to record highs in daily order volume for Alibaba’s instant commerce platforms, writing: “Taobao Instant Commerce and Eleme announced that their combined daily order volume exceeded 80 million on 5 July,” including more than 13 million non-meal orders.

The firm noted that the milestone follows a previous record of 60 million orders on June 23, underscoring what Jefferies called “solid momentum… across segments.”

However, the firm also flagged pressure on margins due to spending on growth, estimating overall EBITA to decline 15% year over year to about RMB38 billion, with a margin of 15%, below consensus expectations of 18%.

For the Taobao Tmall Group segment, which now integrates local services Eleme and OTA Figgy, Jefferies expects a 20% decline in EBITA, citing investment in instant commerce.

Still, the firm remains upbeat on the medium-term trajectory. “We believe the market has formed expectations on investment in instant commerce,” Jefferies wrote, adding that CMR is set to outpace GMV growth, thanks to contributions from QZT and service fees.

Jefferies expects Alibaba to update investors on AI cloud growth, user engagement, and competitive positioning during its upcoming earnings call.

Related articles

Jefferies maintains Buy on Alibaba shares, cites strong AI-driven cloud growth

WK Kellogg stock soars after Ferrero nears $3B acquisition deal

PTC stock soars as Autodesk weighs takeover bid