The EU is gearing up for retaliation in case trade negotiations with Washington fail by 1 August. Should there be no agreement, the US will start charging 30% tariffs on almost all goods imported from the bloc.

After having been caught off guard by a letter threatening the 30% duty on EU goods last weekend, the European Commission has quickly tabled a plan to put countertariffs on US exports worth €72 billion, inevitably hitting the European Union’s own economy.

This is a follow-up on the European Commission's previously proposed list of US products, worth €95bn, that could be hit with EU countertariffs.

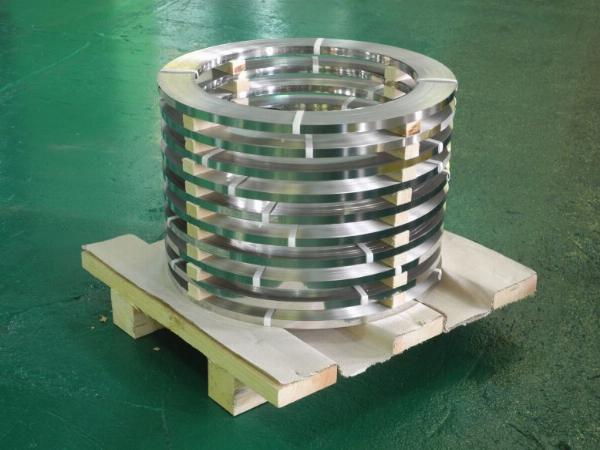

The potential EU retaliatory tariffs target imports of industrial goods from the US, including aircraft and aircraft parts, machinery, automotives, chemicals and plastics, and medical devices and equipment.

These types of imports are worth €65.7bn out of the €72bn total.

It also lists agricultural products, including bourbon, but there are minor though surprising items, such as amusement park rides, toothbrushes, hairbrushes and natural rubber latex.

If imposed, the tariffs mean that European consumers or businesses would buy these products at a higher price, pushing up inflation.

However, according to Sylvain Broyer, chief European economist, S&P Global Ratings, the inflationary effect of countermeasures could be minimal. He told Euronews Business that “EU tariffs on US goods would have only a modest impact on European inflation — likely just a couple of tenths of a percentage point — and are unlikely to significantly affect overall economic activity.”

The bigger risk may come from supply chain disruptions. Where Europe could really feel the pinch is in services: “the EU is highly reliant on US services, particularly in sectors like technology, payments and consulting,” Broyer said.

Which EU countries are hit the most by these countermeasures?

Certain industries, propping up various countries’ economies, could face serious supply chain disruptions if the EU and the US go into a trade war.

Aviation is one of them, as aeroplanes and aircraft parts are some of the products set to be the most dramatically impacted by EU countermeasures. Potential EU import restrictions on these goods, worth nearly €11bn, according to a document from the European Commission.

Within the member states, the country with the biggest US aircraft imports in 2024 was Ireland, followed by France, the Netherlands and Germany.

Aviation between the US and EU is a highly interconnected sector. French multinational aerospace and defence company Thales supplies US-based Boeing and European competitor Airbus with flight management systems and cockpit displays. In exchange, US aerospace giant Honeywell provides flight management systems for Airbus.

Story ContinuesApart from threatening serious breakdowns in the supply chain, the EU’s potential retaliatory tariffs on US-made aircraft is a direct blow to Boeing. The firm sourced 13% or more than $8.7bn (€7.5bn) of its revenues from Europe in 2024.

Any such step from the EU may risk higher US tariffs on European aircraft. For the European firm Airbus, its North America revenue was double that of Boeing’s last year, at more than $16bn (€13.8bn).

Ireland left vulnerable

Potential EU countermeasures on aircraft imports, coupled with retaliation from the US administration, could risk Ireland's position as a world-leading hub in aviation.

Ireland is home to more than 50 aircraft leasing companies managing 10,000 aircraft. According to a recent report by aviation investment group Irelandia, this is equivalent to 37% of the global commercial fleet and makes the country a central player in the world’s air transport infrastructure.

Ireland is already facing a serious hit to its economy due to potentially high US tariffs on its exports to the US after the 1 August deadline. The country is deemed to be one of the most affected economies in the EU, besides Germany.

Brussels-based think tank Bruegel has estimated that Ireland's cumulative real GDP loss, due to the total impact of US tariffs, could be 3% by 2028.

That’s if, as President Trump has promised, pharmaceutical goods face heavy duties.

“In Ireland’s case, the aircraft imports amount to over 1% of GDP, in the Netherlands, the large machinery and medicinal equipment imports are equivalent to 6% of GDP,” Rory Fennessy, senior economist at Oxford Economics, told Euronews Business.

Belgium’s overall imports from the US are equivalent to 5% of GDP.

Machinery is the second most concerned product group on the Commission’s list, imports worth €9.43bn would be hit by countertariffs. That would come as a shock to supply chains in Germany, the Netherlands, France and Ireland.

“Even if countries have a limited direct import exposure to the United States, there can be significant spillovers to other countries simply down to the close supply chain integration and the impact on adjacent support industries due to tariffs,” said Fennessy.

One of the key examples is the close relationship between Germany and the Central and Eastern European countries, including Hungary, Poland and Slovakia, especially with regards to the automotive sector.

Countries in Central and Eastern Europe have been attracting a lot of foreign investment, much of which came from Germany. This plays an important role in driving the region's development.

And vehicles are the third-largest product group exposed to potential retaliatory tariffs. The country with the highest imports of vehicles or parts from the US is Germany, worth nearly €7.5bn in 2024, followed by Belgium (€1.8bn). These countries would feel the most pressure from higher prices in this sector.

“But of course, the exact spillover varies and some countries are more directly exposed in certain sectors, so would likely feel a quicker price impact in such cases,” Fennessy added.

If prices go up, even temporarily, while companies try to find new sources to contribute to their supply chains, that would be another blow to Germany’s ailing automotive sector and could lead to more cost-cutting measures from the major brands, including Volkswagen and Mercedes. These firms have production plants in Hungary and elsewhere in central and eastern Europe.

What other products are concerned?

The European Commission’s product hit list includes chemicals and plastics, as well as medical devices, with each category amounting to more than €7.5bn worth of imports from the US to the EU in 2024.

The most affected countries are Belgium, the Netherlands and Germany.

As for chemicals, the EU nation that buys the most from the US is Belgium, with €13.7bn worth of imports in 2024. That’s followed by the Netherlands with €12.5bn and Germany with €12.3bn. When it comes to plastics, Belgium tops the list with more than €3bn of US imports, followed by Germany (€2bn) and the Netherlands with €1.5bn.

Imports of US medical devices in the EU was the highest in the Netherlands, where these products were worth €4.63bn. That’s followed by Germany, with €2.65bn in imports, and Belgium with more than €1bn.

Related

-

Time for EU to put its gun on the table in US tariff spat, says ex-trade chief

-

Which European economy stands to suffer the most from US tariffs?

The EU is also considering putting retaliatory tariffs on €6.4bn worth of agricultural products, including bourbon whiskey. The country that imports the most bourbon from the US is the Netherlands, buying goods worth more than €60 million a year. This, on its own, may not hurt the economy. But if the European spirits and drinks sector is exposed to Washington’s countermeasures, French wine and Irish whiskey would also be targeted.

If there is no agreement between the US and the EU before Trump’s deadline, the European agricultural sector, among many others, will face a 30% tariff on its exports to the US, a consequence labelled catastrophic by French lobbying groups.

Brussels says it is still seeking a deal to avoid a tit-for-tat escalation in the trade war but is poised to retaliate if needed.