Social media for financial services: 7 tips to ace your marketing strategy

Social media for financial services is often met with some hesitation. Compliance concerns, reputation risks and the general challenge of creating interesting finance content make many brands cautious.

Plus, financial services brands aren’t a monolith. A wealth management firm speaking to high-net-worth investors would have a much different tone and voice online than a regional credit union talking to first-time homebuyers. As a result, it can be hard to know how to tailor your digital marketing strategy accordingly.

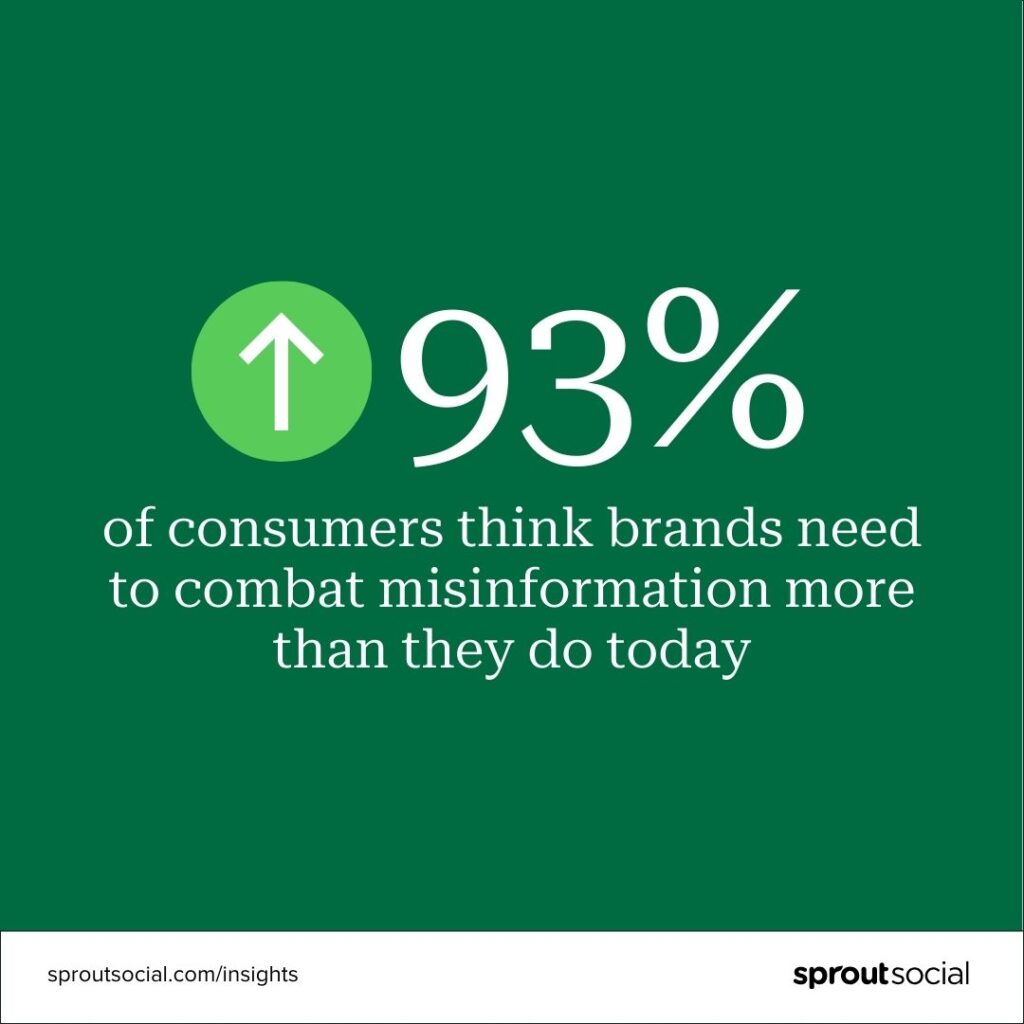

But here’s the thing: social media marketing isn’t just about trends and hashtags. It’s about building trust. At a time when misinformation spreads rapidly online, financial institutions can use social media to inform and protect their audiences. According to our 2025 Sprout Social Index, 93% of consumers think brands need to combat misinformation more than they do today.

Social media marketing is also about connecting with customers where they are. Our 2023 State of Social Media Report found that 90% of consumers expect to be able to contact a business via social media. 71% of consumers are more likely to recommend a brand they follow on social media.

Ready to see what else social media can do for your financial brand? In this article, you’ll learn more about the impact of social media on financial services, as well as tips and examples to help you build a winning social media strategy.

The influence of social media in financial services

In the past, the financial services customer relationship might’ve started with a meeting with a financial advisor. Today, that first impression happens on Instagram, LinkedIn or YouTube.

According to a 2024 RFI Global report, over a third (35%) of American Gen Z and 21% of millennial respondents said they searched for information on specific banking products using social media. Between 46% and 68% of Australian respondents said social media content informed their understanding of banking products.

But just because consumers turn to social media for financial advice doesn’t mean they get it from credible sources. A 2024 FIS study found that less than 25% of Gen Z and Millennial respondents are learning from their financial institutions. This gap presents a major opportunity for financial services brands to step up as trusted advisors in the digital space.

Social media is also an excellent customer service platform. A 2022 American Express report found that social media was the top channel for customer service inquiries. A 2021 J.D. Power Customer Experience Study also found that financial services companies that use social media effectively can see a 20-30% increase in customer satisfaction.

Top social media platforms for financial services

Depending on your target audience and overall marketing goals, some social media platforms may fit your brand better than others.

To help you see which one could be right for you (and figure out what to post), here are three social media platforms to consider focusing on.

Instagram is quickly becoming a go-to social media marketing channel for financial services. Due to its highly visual nature, it’s perfect for brands looking to showcase their personality and make finance more approachable.

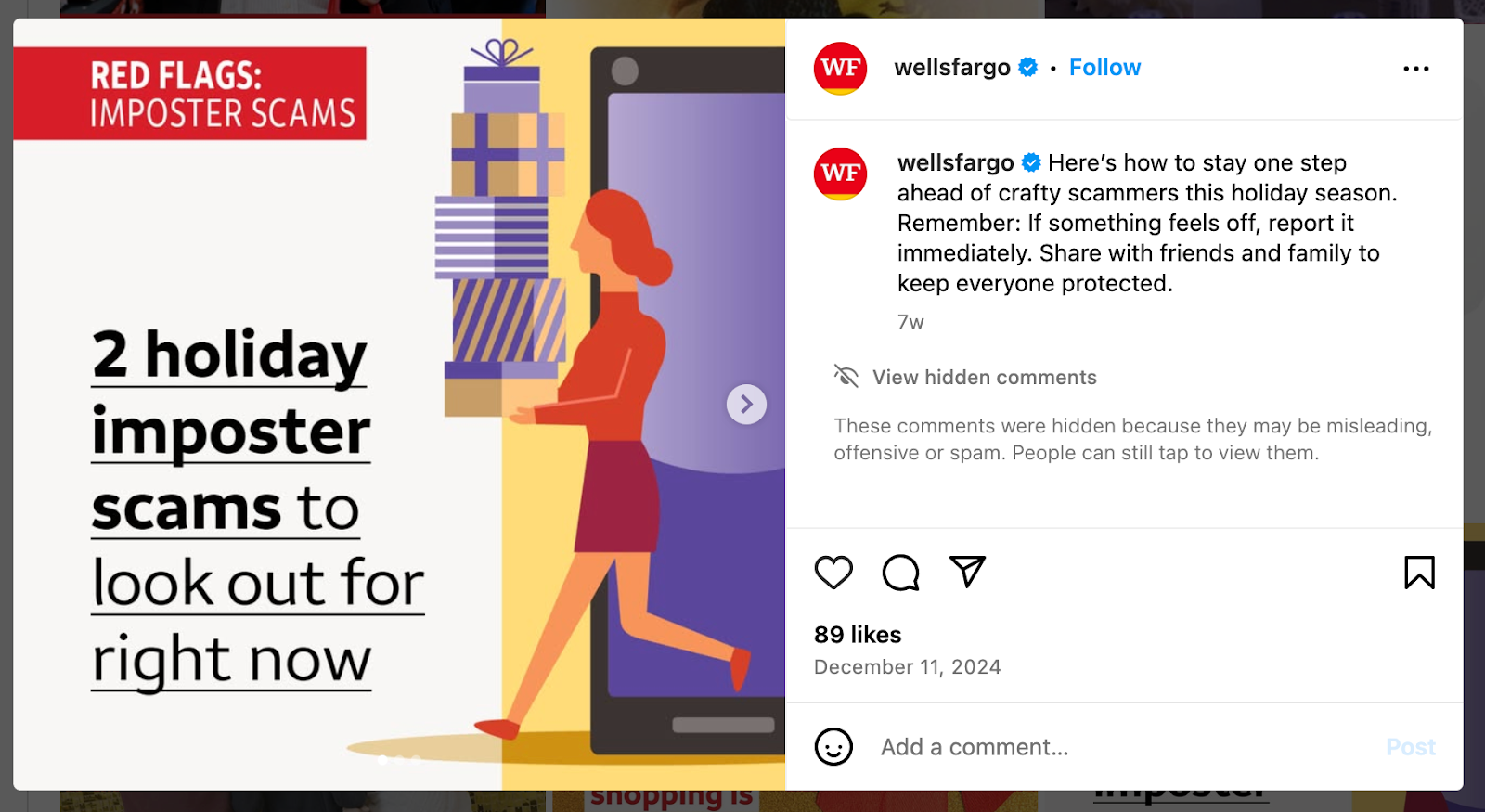

For example, we love how Wells Fargo uses Instagram to highlight its company, culture and community initiatives, such as its Martin Luther King Jr Day of Service.

They also use easy-to-digest infographics to educate their audience on important financial topics, like this imposter scam carousel post.

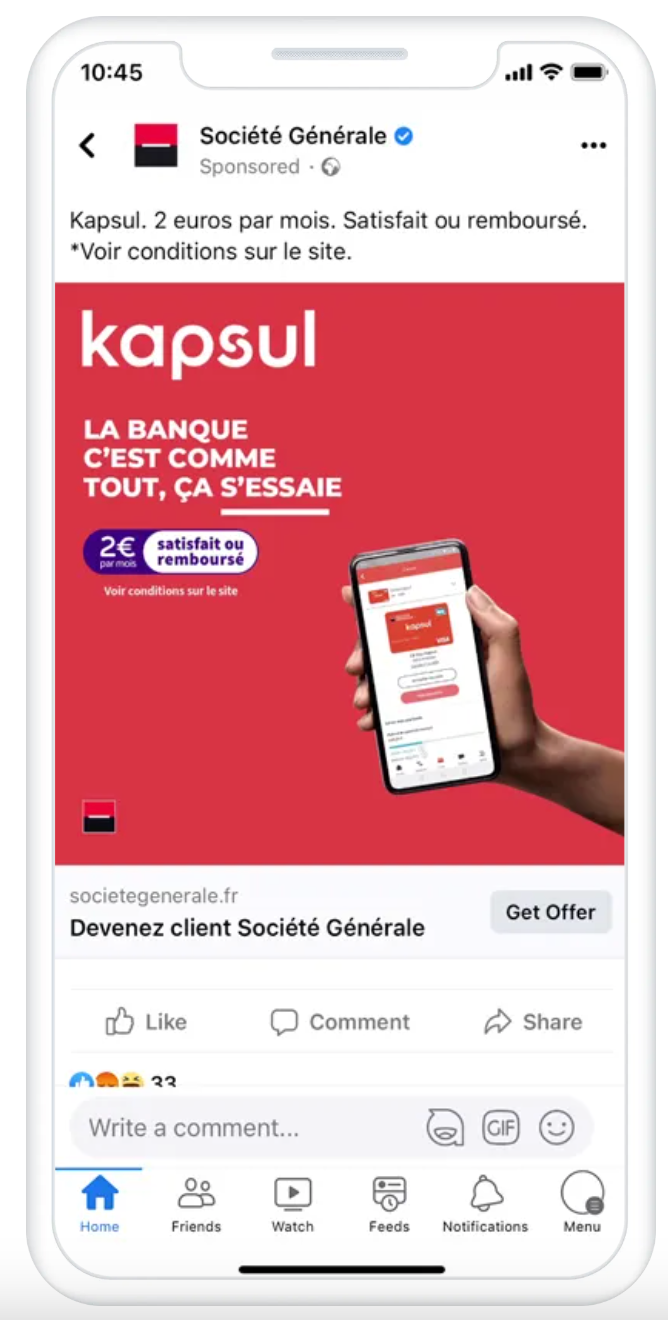

As the largest and most popular social media platform, Facebook is still a powerful channel for digital marketers—especially if you’re interested in paid advertising.

Meta Ads allow brands to run highly-targeted campaigns across Facebook and other Meta-owned platforms. They also offer a wide variety of ad types, placements and delivery methods.

For example, SG, a French bank, used Meta’s Advantage+ placements to optimize ad delivery. Unlike regular Feed ads, Advantage+ automates ad placements across all Meta channels to maximize budget and reach.

And SG’s results speak for themselves. They experienced a 19% decrease in cost per acquisition with a 6% increase in reach compared to Feed placements alone.

LinkedIn is the world’s largest online professional network. Since it’s more business and employment-focused than other social media platforms, it’s a natural fit for financial services brands.

According to LinkedIn research, members are 2 times more likely to seek out financial advice on the platform and 1.7 times more receptive to brand messages.

Accounting software company Xero uses LinkedIn Polls to engage its audience of small business owners. They also post humorous infographics, product announcements and informative carousel posts to entertain and educate their followers.

How to start a financial services social media strategy

Investing in social media marketing without a strategy is like setting out on a road trip without a map. You might get to your destination eventually, but you’ll probably waste a lot of time, energy and resources along the way.

Here’s a step-by-step process for building a financial services social media strategy from scratch.

Conduct a social media audit. Take some time to review your accounts. What’s working (and what’s not)? What’s your audience engaging with? Is your branding consistent? A social media audit will help you establish some guidelines and identify key areas for improvement.Establish clear social media policies and guidelines. Define clear rules, processes and approval workflows for content creation, engagement, compliance and security. Ensure all social team members can easily access these policies by integrating them into your workflows and platforms.Use a consistent and trustworthy brand voice. What are your brand’s core values? How do you want our audience to feel when they interact with you? Use these questions as a jumping-off point to develop clear tone and messaging guidelines. Similar to your overarching social media policies, these guidelines should be easily accessible. Team members should also review all posts to ensure consistency.Use tools for social media management and analytics. Social media management platforms like Sprout Social help streamline and automate many essential social media tasks. Use them to schedule posts, track engagement, monitor brand mentions, analyze performance data and more.Monitor and respond to customer inquiries promptly. Social media never sleeps, so use management tools to track comments and messages. Set up real-time alerts to stay on top of conversations. Reply templates and response workflows also help speed up the process.Build brand trust by building an employer brand. Use social media to highlight company culture, values and employee experiences. For example, we love how CIBC features co-op student profiles on their Instagram page to promote career opportunities. Also, consider empowering employees to be brand advocates. With our Employee Advocacy platform, brands can compile social content into newsletters or broadcasts to share on internal platforms like Microsoft Teams or Slack.Interested in learning more?

Learn how Monzo Bank stands out for their exceptional social presence, not just for financial brands, but all brands. How did one financial institution become a leading brand on social?