Stock Market Today: Dow jumps; S&P 500 and Nasdaq slip originally appeared on TheStreet.

Updated: 4:42 p.m. EDT

Stocks ended mixed Tuesday, as investors moved away from the tech sector and President Donald Trump's budget bill passed in the Senate.

The Dow Jones Industrial Average surged 400.17 points, or 0.91%, to finish the session at 44,494.94, while the S&P 500 slipped 0.11% to close at 6,198.01 and the tech-heavy Nasdaq lost 0.82% to end the day at 20,202.89.

Two markets in one

The stock market opened the second half of 2025 with two markets, two markets in one.

The divergence may be due to weakness among many tech stocks that enjoyed huge gains as the U.S. market rebounded from the April low. These include Facebook-parent Meta Platforms (META) , Microsoft (MSFT) Nvidia (NVDA) and Tesla (TSLA) .

At the same time, one sees sizable gains in big non-tech stocks, which had lagged the market for most of the second quarter. These include: UnitedHealth Group (UNH) , Amgen (AMGN) , Sherwin-Williams (SHW) , Merck MRK and Nike (NKE) . All were up more than 3% midday.

Some of Tuesday's gains were due to Senate passage of President Trump's big tax-and-spending bill after days of sometimes fractious debate. The vote was 51-50 with Vice President J.D. Vance casting the deciding vote.

To give you an idea how fast a stock could give up its 52-week high, consider cyber-security CrowdStrike (CRWD) .

The shares hit its 52-week of $516.62 within five minutes of Tuesday's open and promptly fell 3.3% to $493.09 by 12:57 p.m. ET.

At 3:40 p.m. EDT, the S&P 500 was off 5 points, or 0.1%, to 6,200. Meanwhile, the Nasdaq Composite Index had shed 159 points, or 0.6% to 20,212, while the Nasdaq-100 Index was down 191 points, or 0.8%, to 22,488.

The Dow Jones Industrial Average was up 433points, or 1%, to 44,527, led by Amgen (AMGN) , UnitedHealth, Sherwin-Williams, Nike and Merck (MRK) .

The S&P 500, Nasdaq and Nasdaq-100 indices all ended at record levels for the second quarter on Monday.

Apple makes may make move on AI

Apple (AAPL) was up 1.5% to $208.17 on reports the company is thinking of using artificial intelligence systems from Anthropic or OpenAI in its artificial intelligence applications, especially Siri.

The move suggests Apple's move will accelerate its offerings of state-of-the-art AI features.

Gene Munster, managing partner at Deepwater Asset Management, said on CNBC he likes the idea. But he also wants Apple to buy web search company Perplexity.

Story continuesMarkets ignore Trump calling Powell 'a moron'

The markets did not react to President Trump's calling Federal Reserve Chairman Jerome Powell "a moron."

His remarks came after Powell said he and the Fed were keeping their open when he said steady economic activity was giving the central bank time to study the effects that tariff increases have on prices and growth before resuming interest-rate reductions.

Powell made his remarks during a speech in Portugal.

Updated: 9:45 a.m.

A mixed open to the second half

Stocks had a mixed start to open the second half of 2025.

Tech stocks were mostly lower. More classic industrial and staples stocks were showing nice gains.

Only three sectors of the Standard & Poor's 500 were higher, led by the Consumer Staples stocks such as Hershey (HSY) , up 2.7%; Target TGT, up 1.8%; cosmetics maker Estee Lauder (EL) , up 1.5%; and J.M. Smucker (SJM) , up 1.9%.

Big tech stocks were all lower, but the declines were modest. Except for Tesla (TSLA) , down 4.3% to about $304. Partly that's due to CEO Elon Musk's ongoing feud with President Trump (see below and partly due to the possibility that tax credits for electric vehicles may be removed by the president's big beautiful tax bill.

At 10:10 a.m. EDT, the S&P 500 was off 02% to 6,199. The Nasdaq Composite Index had shed 0.2% to 20,322.

The Dow Jones Industrial Average was up 240 points to 44,325, led by Nike (NKE) Apple (AAPL) and health insurance giant UnitedHealth Group (UNH) .

Nvidia (NVDA) was the Dow's biggest decliner, down nearly 3% to $153.24.

Stock Market Today

The first half of the year was a rocky one that ended in the green. As we reported in yesterday's end-of-quarter summary, stocks finished up around 5% after having been in bear market territory.

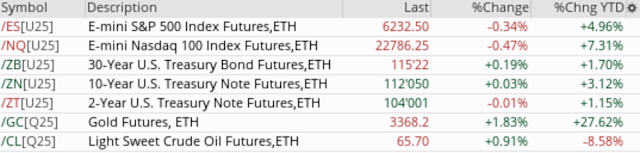

For the first trading day of the quarter, stocks appear headed lower, the long end of the treasury curve higher (yields lower), and both gold and oil are up.

What's driving the drop in stocks? Well, what drove the rally? Honestly, stocks are overbought, as I mentioned in my Friday column on TheStreet Pro. Expect some profit taking as investors reduce risk following a strong quarter.

Today's news, however, is the tax bill, aka the Big Beautiful Bill. Senate Republicans are still arguing over aspects of the bill as Trump's July 4th deadline approaches. With Democrat senators united against the bill, which will raise the deficit by $3 trillion, Republicans can only afford to lose three votes and are working hard to find ways to support those states with senators that are on the fence.

I'll also be watching Tesla (TSLA) today as the Trump/Musk feud intensifies.

and..

I wrote back in April that Musk could send Tesla stock soaring by leaving the company. If Trump deports Musk, perhaps Tesla shareholders would benefit?

Related: How Elon Musk could send Tesla stock soaring

Stock Market Today: Dow jumps; S&P 500 and Nasdaq slip first appeared on TheStreet on Jul 1, 2025

This story was originally reported by TheStreet on Jul 1, 2025, where it first appeared.