Terreno Realty's Rent Rises in Q2, Occupancy Improves Y/Y

Terreno Realty Corporation TRNO recently provided an update on its operating, investment and capital market activity for the second quarter of 2025. Per the second-quarter 2025 update, TRNO locked in higher rents on new and renewed leases, and occupancy improved year over year. Nevertheless, accretive acquisitions and developments are likely to support its growth in the upcoming period.

Let’s gather insight on the line items on which the company has provided an update.

TRNO’s Operating Activity

In the second quarter of 2025, this industrial REIT witnessed a 22.6% increase in cash rents on new and renewed leases. The leases that commenced in the second quarter totaled around 0.8 million square feet and 9.2 acres of improved land. The tenant retention ratio was 71.1% for the operating portfolio and 100% for the improved land portfolio.

As of June 30, 2025, the occupancy for the operating portfolio was 97.7%, which marks an expansion of 110 basis points (bps) sequentially and 170 bps year over year. For the same-store portfolio of around 14.1 million square feet, TRNO had 98.5% quarter-end occupancy, up 110 bps sequentially and 240 bps year over year.

As of June 30, 2025, the occupancy for the improved land portfolio was 95.1% compared to 95.1% recorded at March 31, 2025, and 98.1% at June 30, 2024.

As of June 30, 2025, Terreno Realty’s portfolio included 297 buildings spanning around 18.9 million square feet and 47 improved land parcels encompassing 150.6 acres leased to 662 tenants.

TRNO’s Investment Activity

TRNO has been actively restructuring its portfolio by disposing of non-core assets and acquiring value-accretive investments. Such efforts will aid long-term revenue growth.

In the second quarter of 2025, Terreno Realty sold two properties, including six buildings spanning around 584,000 square feet, at an aggregate sale value of $114.5 million. In the same period, the company acquired six industrial properties, including six buildings spanning around 305,000 square feet, for an aggregate purchase value of $123.5 million.

As of June 30, 2025, TRNO had acquisitions worth around $10.3 million under contract and nearly $435 million under letters of intent. Moreover, the company has around $9.5 million of dispositions under contract and nearly $231.3 million of dispositions under access agreements, where due diligence has commenced.

TRNO’s Development and Redevelopment Activity

As of June 30, 2025, Terreno Realty had six properties under development or redevelopment. Post completion, these will comprise nine buildings spanning around 0.9 million square feet, which are 47% leased. The company also has around 22.4 acres of land dedicated to future developments at an estimated investment value of around $436.4 million.

Story ContinuesTRNO’s Capital Market Activity

In the second quarter of 2025, Terreno Realty did not issue any shares of common stock under the company’s at-the-market equity offering program. In the same period, the company also did not repurchase any shares under its share repurchase authorization.

On the balance sheet front, as of June 30, 2025, the company had no borrowings outstanding under its $600 million revolving credit facility. It has no debt maturities in 2025, while $50 million of debt is maturing in 2026.

TRNO: In a Snapshot

In a rising e-commerce market, the industrial real estate asset category is playing a pivotal role, transforming the way consumers shop and receive their goods. Companies are making immense efforts to improve supply-chain efficiencies, propelling demand for logistics infrastructure and efficient distribution networks. Given Terreno’s solid capacity to offer modern logistics facilities, it is well-poised to bank on this trend.

With a solid operating platform, strategic expansion moves and a healthy balance sheet position, TRNO seems well-positioned to capitalize on long-term growth opportunities amid favorable industry fundamentals.

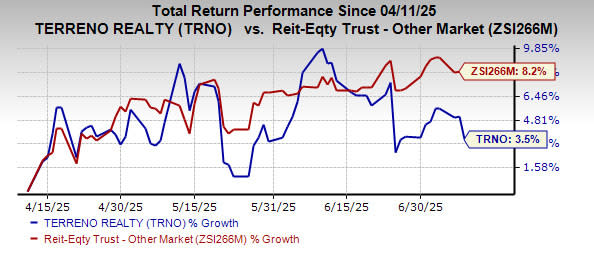

In the past three months, shares of this Zacks Rank #4 (Sell) company have gained 3.5% compared with the industry's growth of 8.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector include SBA Communications SBAC and Omega Healthcare Investors OHI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SBAC’s 2025 FFO per share has moved 3 cents northward to $12.74 over the past two months.

The Zacks Consensus Estimate for OHI’s 2025 FFO per share has moved a cent northward to $3.03 over the past week.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Omega Healthcare Investors, Inc. (OHI) : Free Stock Analysis Report

Terreno Realty Corporation (TRNO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research