U.S. housing crisis sparks boom in crypto-backed mortgages originally appeared on TheStreet.

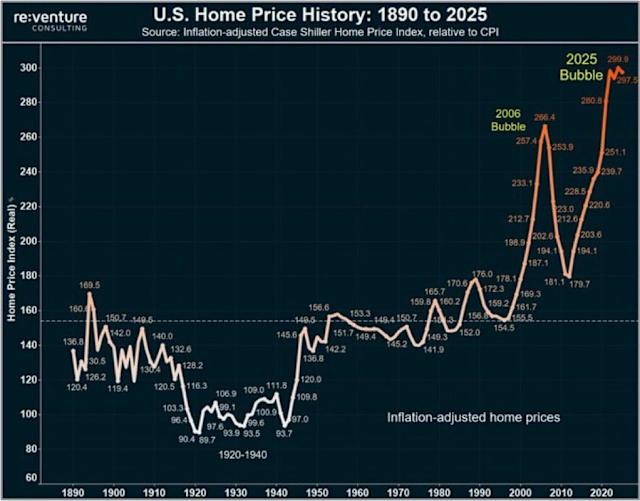

With home prices setting new records amid inflation, there is a growing fear that the housing market is forming a bubble and a housing crisis is looming. According to Reventure Consulting's "U.S. Home Price History: 1890 to 2025," home prices in the U.S. reached an all-time high in 2025.

That exceeds the 2006 high of 266.4, unprecedented affordability headwinds. There were a historically low 1.6 months' worth of homes for sale in the U.S. in January 2022, according to the National Association of Realtors (NAR).

According to reports, this metric represents the number of homes available for sale. As of 2025, while there are significantly more homes today than there were back then, it is not enough to satisfy demand, making prices go up.

Shop Top Mortgage Rates

Your Path to Homeownership

Learn MoreA quicker path to financial freedom

Learn MorePersonalized rates in minutes

Learn More Powered by Money.com - Yahoo may earn commission from the links above.A new asset class has emerged as a solution to the housing crisis: cryptocurrency as collateral to secure a mortgage, which opens up new possibilities for homeownership and investment.

Soaring home prices are pricing many buyers out of the market, particularly younger and lower-income households. Tokenized real estate and crypto-backed loans are rapidly changing access points.

They divide properties into fungible, digitized shares and use blockchain to make them tradable. This makes owning a house accessible to average investors and allows the average person to co-own a piece of real estate without having to make hefty down payments, which may help relieve some demand in the housing market.

Crypto as collateral in a mortgage

On June 4, JPMorgan Chase started accepting spot Bitcoin ETFs as collateral for loans — a decision that could lead to more crypto-backed lending on Wall Street. Global capital is also flowing into the U.S. market via decentralized finance (DeFi). By placing homes on-chain, foreign digital-native investors can indirectly finance new development and lower costs.

Many new organizations, such as Ledn, Milo, USDC.homes, etc., have been pioneering the crypto mortgage movement. According to National Mortgage Professional, Milo has reported over $65 million in crypto loan mortgages across its various loan products.

Interestingly, Maple Finance surged past $1 billion in assets under management in 2025, establishing itself as DeFi's premier institutional lending marketplace.

Ledn co-founder Mauricio Di Bartolomeo told TheStreet Roundtable that U.S. regulators had sparked a "Cambrian explosion" in Bitcoin-backed lending. The use of blockchain-based smart contracts increases efficiencies, as these agreements are self-executing. Smart contracts can automate the terms of a loan, reducing paperwork.

Story ContinuesHowever, having cryptocurrency as collateral for a mortgage has its risks: the extreme volatility of pricing can expose parties to margin calls, most loans require over-collateralization, and the list of assets acceptable as collateral is limited.

Rates are often higher than conventional mortgages, funds are held with custodians (locked), and regulatory uncertainty provides no standard protection or guarantees to borrowers.

As the housing crisis deepens, the intersection of traditional finance and innovation within blockchain could be a valuable tool for addressing the problem.

U.S. housing crisis sparks boom in crypto-backed mortgages first appeared on TheStreet on Jul 3, 2025

This story was originally reported by TheStreet on Jul 3, 2025, where it first appeared.

![Lobster Market Growth: Key Factors Driving Expansion to USD [9.6 Billion] by {2029}](https://noticiasdecostarica.com/zb_users/upload/2025/07/20250714121902175246674235065.png)