(Bloomberg) -- Vanguard Group is planning its debut into an increasingly competitive corner of the $11.6 trillion US exchange-traded fund arena.

Most Read from Bloomberg

-

Struggling Downtowns Are Looking to Lure New Crowds

-

Sprawl Is Still Not the Answer

-

California Exempts Building Projects From Environmental Law

Invest in Gold

Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase

Learn More

Thor Metals Group: Best Overall Gold IRA

Learn More

American Hartford Gold: #1 Precious Metals Dealer in the Nation

Learn More Powered by Money.com - Yahoo may earn commission from the links above.The Vanguard High-Yield Active ETF would trade under the ticker VGHY and invest at least 80% of its portfolio in high-yield debt, according to a Tuesday filing with the Securities and Exchange Commission. The fund’s proposed fee is 0.22% — cheaper than any existing actively managed high-yield ETFs, data compiled by Bloomberg showed.

VGHY looks set to mark Vanguard’s first foray into the junk-bond ETF universe. The Jack Bogle-founded firm, which oversees more than $10 trillion globally, has zeroed in on active fixed-income as an avenue for growth. But it faces stiff competition: just last week, JPMorgan Asset Management — which ranks as the fastest-growing asset manager — launched its first active high-yield ETF with a $2 billion investment from a mystery anchor.

While VGHY’s proposed fee is half that of the JPMorgan fund’s 0.45% expense ratio, that likely won’t be a huge differentiating factor, according to Bloomberg Intelligence’s Eric Balchunas, who is also the author of The Bogle Effect.

“JPMorgan is so on fire lately with their active funds that even Vanguard is on notice,” he said. “Their low fee will have less impact than in old days. The Vanguard Effect has actually spread faster than Vanguard itself in many cases now.”

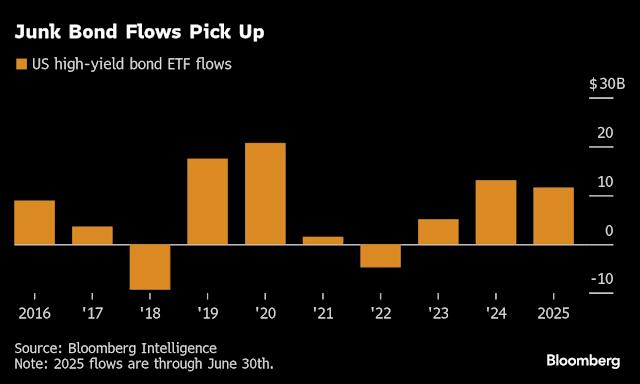

In addition to JPMorgan Asset Management, Capital Group also unveiled its first actively managed high-yield ETF last week. Junk-bond ETFs have attracted roughly $11.6 billion so far this year, according to data compiled by Bloomberg, with inflows accelerating over the past two months as corporate earnings stayed resilient despite uncertainty over tariffs.

Vanguard, long known for its index-tracking funds, has launched at least two actively managed ETFs so far this year, bringing its total stable to 12 funds. Assets in active ETFs now account about 10% of the overall industry, compared to less than 5% a decade ago, Bloomberg Intelligence data show.

“You know the active movement is big when Vanguard is launching more funds in the space than they have in what feels like ages,” said Todd Sohn, senior ETF analyst at Strategas Research. “Active is 10% of ETF assets now — lots of room to grow.”

Most Read from Bloomberg Businessweek

-

SNAP Cuts in Big Tax Bill Will Hit a Lot of Trump Voters Too

-

How to Steal a House

-

America’s Top Consumer-Sentiment Economist Is Worried

-

China’s Homegrown Jewelry Superstar

-

Pistachios Are Everywhere Right Now, Not Just in Dubai Chocolate

©2025 Bloomberg L.P.